Identity & Access Management

,

Security Operations

Legion Partners Calls on Identity Verification Provider to Reduce Costs, Find Buyer

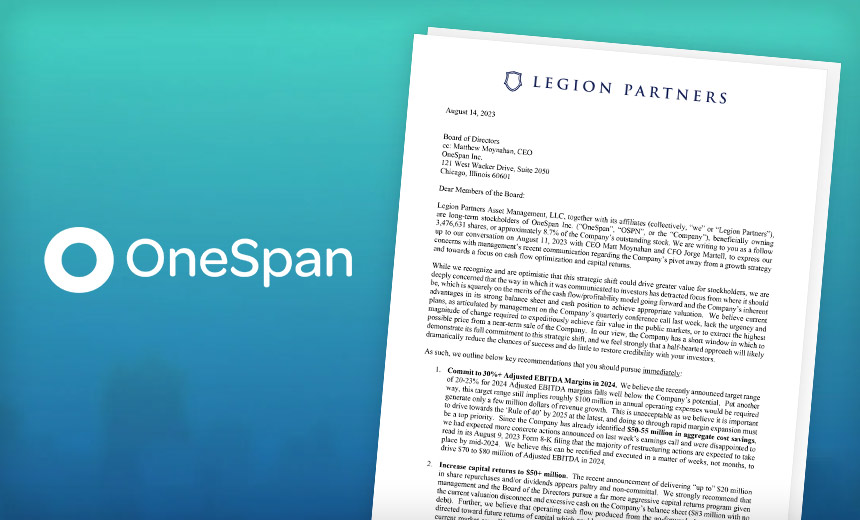

An activist investor urged identity verification and e-signature provider OneSpan to cut costs, return more money to shareholders and find a buyer for the company.

See Also: Live Webinar | Unmasking Pegasus: Understand the Threat & Strengthen Your Digital Defense

“We believe the board of directors should pursue an immediate sale,” Legion Partners Managing Directors Chris Kiper and Ted White wrote in a letter Monday. The firm owns 8.7% of the company’s outstanding stock.

“We strongly believe there are numerous strategic and financial parties interested in acquiring OneSpan given its highly attractive and stable customer base, and that a sale of the company likely represents the best risk-adjusted alternative.”

OneSpan’s stock climbed $0.70 – or 6.57% – in trading Monday to $11.44 per share, the highest the company’s stock has traded over the past three days. The company currently has a valuation of $457.1 million. OneSpan declined Information Security Media Group’s request for comment on the letter.

Legion Partners’ call for a sale comes five months after Reuters reported Chicago-based OneSpan was working with investment bank Evercore on a sale process that could attract offers from other businesses and private equity firms. No take-private offers have materialized to date for OneSpan, which first went public on the Nasdaq Stock Exchange in early 2000 under the name Vasco Data Security (see: E-Sign on the Dotted Line: OneSpan Emerging as an M&A Target).

“We believe it could take far longer to rebuild credibility and achieve fair value in the public markets,” Kiper and White wrote. “The commitment to a more profitable operating plan … will likely generate even more interest in OneSpan.”

Legion Partners is OneSpan’s second-largest shareholder, behind only passive investor BlackRock, which holds a 16.2% position. OneSpan’s fifth-largest shareholder is also an activist hedge fund – Altai Capital Management, which holds a 5.8% stake in the company, according to regulatory filings. Founder and longtime board director Ken Hunt is OneSpan’s third-largest shareholder, and Vanguard is fourth.

Current Plans Lack ‘Urgency and Magnitude of Change Required’

This isn’t the first time Legion Partners has called out OneSpan’s management. The activist investor in May 2021 urged OneSpan to replace four existing board members with its own nominees and to seek new ways to monetize assets. OneSpan and Legion made a deal in which two of Legion’s picks would join the board and three of the members Legion wanted to oust would leave over the next year.

OneSpan last week expanded its restructuring plan to include workforce reductions to achieve a further $30 million of cost savings by the end of 2025. The layoffs will wrap up around mid-2024 and will allow the company to hit adjusted EBITDA – earnings before interest, taxation, depreciation and amortization -of 20% to 23% by the end of 2024. OneSpan also expects a restructuring charge of $15 million to $20 million.

Company CEO Matt Moynahan told investors last week the company intends to return up to $20 million to stockholders by the end of 2023 through stock repurchases, dividends or a combination of both. Sales in the first six months of 2023 climbed 7.7% to $113.3 million, and net loss worsened 458.7% to $26.1 million, or $0.65 per share. OneSpan missed analyst estimates for both sales and earnings last quarter.

“We believe current plans, as articulated by management on the company’s quarterly conference call last week, lack the urgency and magnitude of change required to expeditiously achieve fair value in the public markets or to extract the highest possible price from a near-term sale of the company,” Kiper and White wrote.

Legion Calls Capital Returns Proposal ‘Paltry and Non-Committal’

Legion Partners said it would like to see OneSpan conduct layoffs and other restructuring actions “in a matter of weeks” rather than by mid-2024, and it wants to company to commit to 30% EBITDA margins by late 2024. The activist investor called OneSpan’s capital returns proposal “paltry and non-committal” and said the company should boost its returns to $50 million given the “excessive cash” on its balance sheet.

“The company has a short window in which to demonstrate its full commitment to this strategic shift,” Kiper and White wrote. “We feel strongly that a halfhearted approach will likely dramatically reduce the chances of success and do little to restore credibility with your investors.”

Legion Partners said it had spoken with Moynahan and OneSpan Chief Financial Officer Jorge Martell on Friday to express its concerns with how the company’s pivot from growth to cash flow optimization and capital returns was communicated. Moynahan has led OneSpan since late 2021, after spending five years as Forcepoint’s CEO, which culminated in the sale of the Raytheon subsidiary to Francisco Partners for $1.1 billion (see: OneSpan CEO on Joining Identity Verification and e-Signature).

“With swift action, we believe the board can help oversee the delivery of significant value to OneSpan’s owners,” Kiper and White wrote. “We hope our views are given serious consideration and management and the board begin to take more immediate action to accelerate and enhance its plans.”