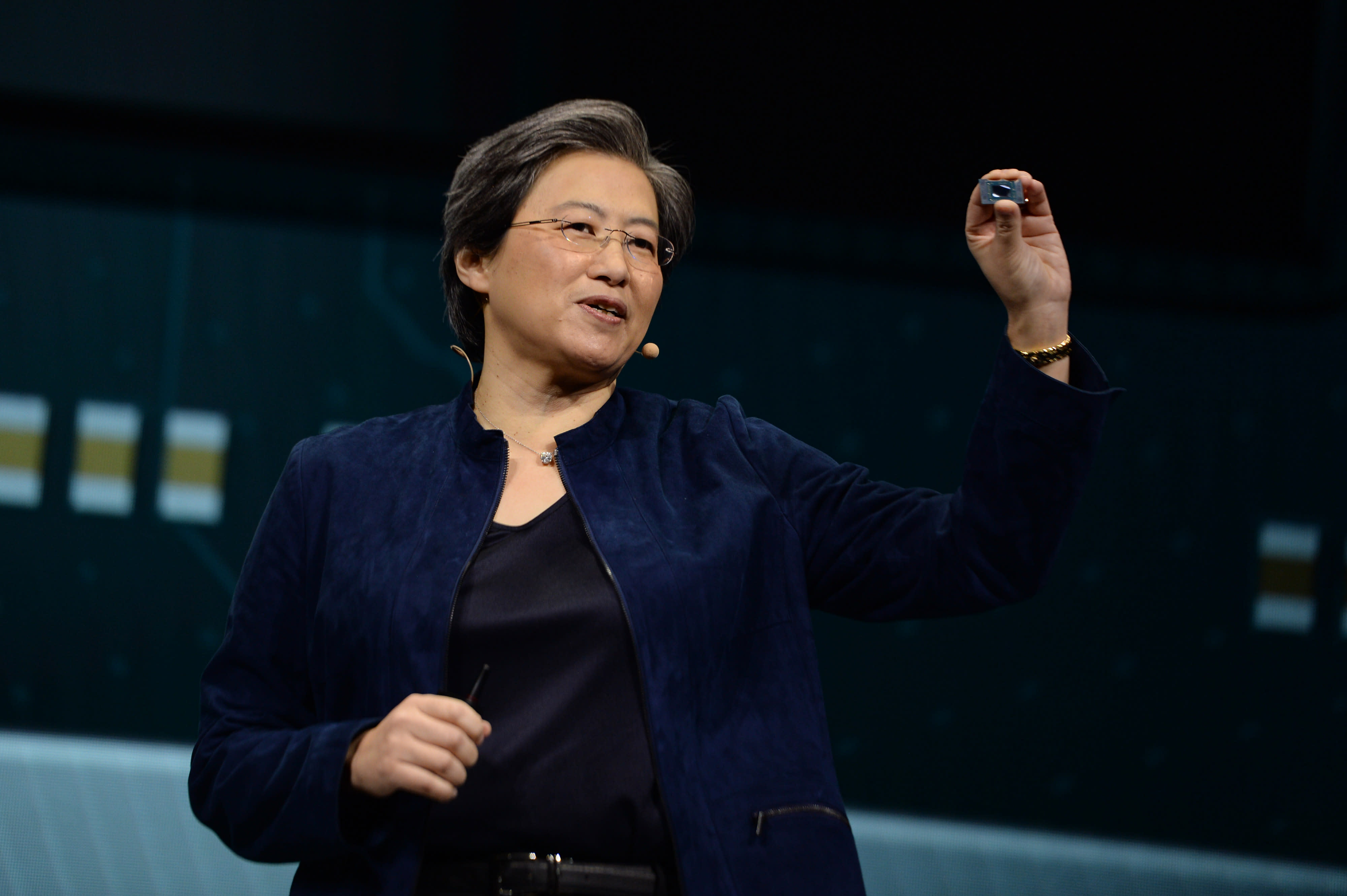

AMD Chair and CEO Dr. Lisa Su delivers a keynote address at CES 2023 at The Venetian Las Vegas on January 04, 2023 in Las Vegas, Nevada.

David Becker | Getty Images

AMD reported better-than-expected revenue and earnings for the first quarter, but the stock dropped 6% in extended trading on Tuesday after the chipmaker issued guidance for the current period that trailed analysts’ estimates.

Here’s how the company did versus Refinitiv consensus estimates for the quarter ended in December:

- EPS: 60 cents per share adjusted vs. 56 cents per share expected

- Revenue: $5.35 billion vs. $5.3 billion expected

AMD said it expected about $5.3 billion in sales in the current quarter, versus Wall Street estimates of $5.48 billion. AMD CEO Lisa Su said in a statement that the company sees “growth in the second half of the year as the PC and server markets strengthen.”

The company’s net loss swung to $139 million, or 9 cents per share, from a net income of $786 million, or 56 cents per share, during the year-earlier period. AMD excludes certain losses on investments and acquisition-related costs from its earnings.

Revenue dropped 9% from $5.89 billion a year earlier.

The biggest decline came in AMD’s client group, which includes sales from PC processors. AMD reported $739 million in sales in the category, a 65% decrease from $2.1 billion in sales during the same period last year.

AMD’s report comes as the PC industry is in a deep slump, with shipments dropping 30% in the first quarter, according to IDC. Last week, Intel, AMD’s primary competitor in the PC and server chip markets, reported that its overall sales declined 36%.

“We believe the first quarter was the bottom for our client processor business,” Su said.

AMD’s data center segment sales edged up to $1.295 billion from $1.293 billion during the year-earlier period. The company said the category is likely to grow in the current quarter.

“I would say from an overall market standpoint, I think enterprise will still be mixed, with the notion that we expect some improvement. Depends a little on the macro situation,” Su said.

Sales in its embedded segment of less powerful chips for networking soared to $1.56 billion from $595 million year over year, partially due to additional revenue from the company’s purchase of Xilinx.

AMD’s gaming segment, which includes graphics processors for PCs as well as chips for consoles like Sony PlayStation 5, reported $1.76 billion in sales, down slightly from $1.88 billion last year.

Correction: The $5.3 billion revenue expectation was misstated in an earlier version.