Litigation

,

Network Firewalls, Network Access Control

,

Security Operations

Pension Funds Say Fortinet Leaders Misled Market With Overly Rosy Refresh Outlook

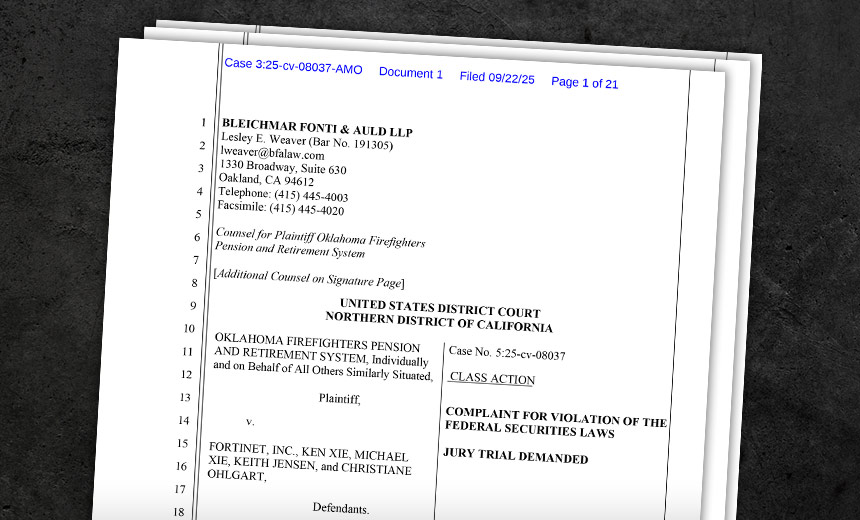

A pair of class action lawsuits filed recently accuse Fortinet of violating federal securities laws by making misleading statements about a “record” firewall refresh cycle.

See Also: Achieve Machine Learning Results Faster

Pension funds in Oklahoma and Rhode Island accused Fortinet of misleading investors by touting in late 2024 a major firewall refresh cycle for a quarter of its install base, predicting it would yield more than $400 million. But Fortinet allegedly knew the refresh involved older products representing a small percentage of business, and pushed through much of the refresh earlier than what they told investors.

“In 2026, a record number of FortiGates will reach the end of their support life cycle, and we expect these customers to start the refresh cycle for these products sometime in 2025,” former Fortinet Chief Financial Officer Keith Jensen told investors in November 2024. “I think that we see the end-of-life of these products starting in the second half of 2026.”

Once it became apparent in August 2025 the firewall revenue cycle wouldn’t have a material impact on revenue, Fortinet’s stock price dropped by more than 22%, according to the lawsuits. Plaintiffs also allege insider trading, noting that CEO Ken Xie and CTO Michael Xie sold millions of dollars in stock just days before the August earnings call. Fortinet didn’t respond to multiple requests for comment (see: Palo Alto, Fortinet, Check Point Control Firewall Gartner MQ).

Lawsuit Says Firewall Refresh Didn’t Live Up to Expectations

At the center of the lawsuits is Fortinet’s promotion of a massive refresh cycle for its FortiGate firewalls, with executives claiming it was “by far the largest” refresh opportunity in the company’s history and it would drive not only product sales but also service upsells and cross-selling opportunities. Analysts responded favorably, and the company’s stock price jumped nearly $9 per share overnight in response.

“We don’t expect the customers to wait until the 11[th] hour to make the change,” Jensen told investors in November 2024. “For larger enterprises, they would go through another certification, [proof of concept] project perhaps as part of that before they place them in service.”

In February 2025, Fortinet described “early upgrade movement” and forecasted stronger activity in the coming quarters, while in the spring, executives reiterated the importance of the refresh and described it as “10 times larger” than prior cycles, according to the lawsuit. But after the August earnings call, the suit said analysts immediately downgraded Fortinet and criticized the company’s previous statements.

“In the fourth quarter [of 2024], we saw early upgrade movement with large enterprises, both on buying plans and actual purchases,” Jensen told investors in February 2025. “We expect the momentum to build as we move into the second half of 2025 and as we get closer to the 2026 [ending] service dates.”

The lawsuits allege that executives knew the refresh cycle was materially less impactful than they told the market since the refresh was mostly made up of legacy models that represented a small percentage of the company’s business. Executives allegedly knew many customers wouldn’t upgrade since they had “excess capacity” from firewalls bought during the pandemic and didn’t need to replace aging hardware.

“As we wait for evidence of a meaningful refresh cycle, which management reiterated we could see in the back half of this year, we think the stock will remain range bound as we wait for evidence of a meaningful refresh cycle that we think is already largely priced in at these levels,” analysts wrote after Fortinet’s May 2025 earnings call.

Lawsuit Alleges Insider Stock Sales Were Suspiciously Timed

Fortinet executives revealed during an August 2025 earnings call that the company already completed 40 to 50% of the refresh cycle by June 30, with a significant portion of upgraded devices being too old and too small in value to materially affect current revenues. This allegedly blindsided investors who expected that revenue from the refresh would be forthcoming in the second half of 2025 and throughout 2026.

“I do believe it’s in that way we try to help the customer to upgrade the new SASE firewall instead of having too big a business impact,” CEO Ken Xie told investors in August 2025. “Because, like I said, the end of service, that’s the product being there 12, 15 years ago. It’s a pretty small percentage of our total business.”

The August 2025 earnings call triggered a wave of analyst skepticism, with questions around why the refresh hadn’t delivered the promised upside and whether product revenue excluding refresh sales had gone flat or negative. Executives gave ambiguous answers, according to the lawsuit, with CFO Christiane Ohlgart acknowledging that they had limited data on actual customer behavior for many units.

“We have a good handle on the lower end of the firewalls where it’s with enterprise customers,” Ohlgart told investors in August 2025. “In retail or other scenarios, OT scenarios, where it’s harder for us to predict. And we can only track registration rates and similar is in the lower end. The expectations by the Street might have been a little bit higher.”

Both complaints allege suspiciously timed insider stock sales, with CEO Ken Xie selling $15 million and CTO Michael Xie selling $47 million worth of stock just two days before the company’s August earnings call, while Jensen sold $11.5 million of stock between November 2024 and August 2025. These sales allegedly occurred while the executives had non-public knowledge about the impact of the refresh cycle.

“By artificially inflating Fortinet’s stock price, defendants deceived plaintiff and the class … causing them to suffer substantial losses, i.e., damages under the federal securities laws, when the truth was revealed,” the Rhode Island Retirement System wrote Oct. 16.