Governance & Risk Management

,

Network Firewalls, Network Access Control

,

SASE

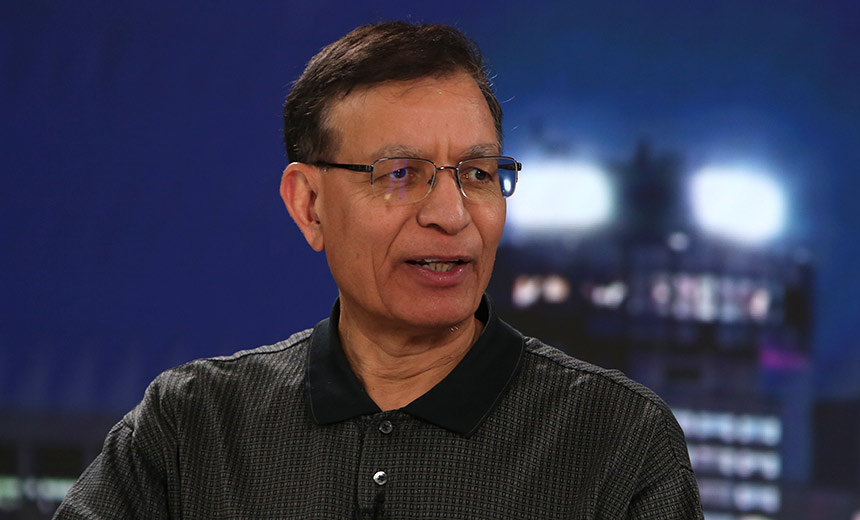

Jay Chaudhry Says Palo Alto Offering Free Products to New Platform Users Won’t Work

Zscaler CEO Jay Chaudhry said Palo Alto Networks’ strategy of offering free products to new platform customers will “unravel over time” as firewalls become shelfware.

See Also: User Entity & Behavior Analytics 101: Strategies to Detect Unusual Security Behaviors

The San Jose, California cloud security firm said legacy vendors like Palo Alto Networks find themselves “in a defensive position” as the role of firewalls diminishes and demand for zero trust security grows, according to Chaudhry. In response, Chaudhry said vendors attempt to give away their less successful products as part of a bundle, but that eventually fails as clients realize they’re not using the free tools (see: Zscaler Taps Generative AI to Measure Risk, Predict Breaches).

“Fundamentally, cyber is so mission critical that customers will invest in the industry’s leading solutions rather than rely on cheaper and less effective products that are included as part of an ELA [enterprise license agreement] bundle,” Chaudhry told investors Thursday.

Palo Alto Networks announced last week it would offer up to six months of free products to customers switching to its platform, which spans network security, cloud security and security operations. The deal allows organizations to “trade in” products from rival vendors that are still under contract and switch to Palo Alto Networks’ version of the same technology without having to pay for both tools simultaneously.

But Zscaler sees the promotion as an attempt to fend off the shift in customer buying behavior from firewalls to zero trust security, which Chaudhry said mirrors the transition from data center tools to the public cloud. Palo Alto Networks didn’t immediately respond to an Information Security Media Group request for comment.

“Many vendors have been trying to give stuff away from a while, and we have been successfully winning against this strategy for a long time,” Chaudhry said. “Look at our retention rate. It used to be mid-90s at IPO [in 2018]; now, its high 90s.”

Do Organizations Have Too Many Security Products?

Palo Alto Networks and Zscaler have a strong difference in opinion around what security and technology buyers want. The former has talked in recent months about “customer fatigue,” detailing in August that organizations are tired of managing 75 different security tools that often interfere with one another. But Chaudhry said Thursday that Zscaler customers don’t have fatigue around spending on cybersecurity.

Customers instead are focusing their scrutiny on enterprise license agreements given the frequency with which products that are bundled or given away end up collecting dust on a shelf, according to Chaudhry. But Palo Alto Networks sees things differently, offering free firewalls to U.S. customers in summer 2023 and agreeing to provide enterprise browsers to SASE customers at no cost for the next 12 months.

“If you want to buy a pacemaker, you don’t try to cut corners.”

– Jay Chaudhry, founder, Chairman and CEO, Zscaler

Chaudhry doesn’t believe SASE competitors will be able to undercut Zscaler on price since customers see it as mission critical like an ERP system rather than as a feature that can be commoditized like CASB, CSPM or sandboxes. Zscaler hasn’t seen much of the firewall vendors that claimed to have entered the SASE market in recent months since their ineffectiveness against new threats makes them less credible.

“Price is a secondary factor. Reliability, availability and the effectiveness of cyber protection is the most important factor,” Chaudhry said. “If you want to buy a pacemaker, you don’t try to cut corners and buy one on sale.”

Sales Surge, Losses Lessen

| Zscaler | Quarter Ended Jan. 31 2024 | Quarter Ended Jan. 31 2023 | Change |

|---|---|---|---|

| Revenue | $525M | $387.6M | 35.4% |

| Net Loss | $28.5M | $57.5M | 50.4% |

| Loss Per Diluted Share | $0.19 | $0.40 | 52.5% |

| Non-GAAP Net Income | $121.1M | $57.6M | 110.2% |

| Non-GAAP Earnings Per Diluted Share | $0.76 | $0.37 | 105.4% |

Zscaler’s revenue of $525 million in the quarter ended Jan. 31 beat Seeking Alpha’s sales estimate of $506.8 million. And the company’s non-GAAP earnings of $0.76 per share crushed Seeking Alpha’s estimate of $0.58 per share.

The company’s stock is down $18.17 – 7.51% – to $223.80 per share in after-hours trading Thursday, which is the lowest the company’s stock has traded since Feb. 21. The Americas accounted for 54% of Zscaler’s revenue in the most recent fiscal quarter, while EMEA and APAC generated 31% and 15% of the company’s sales, respectively, Chief Financial Officer Remo Canessa said.

For the quarter ending Jan. 31, Zscaler expects non-GAAP net income of $0.64 to $0.65 per share on revenue of between $534 million and $536 million. That’s better than analyst projections of non-GAAP net income of $0.59 per share on sales of $530.9 million, according to Seeking Alpha.