An animated avatar generated by the AI video platform Synthesia.

Synthesia

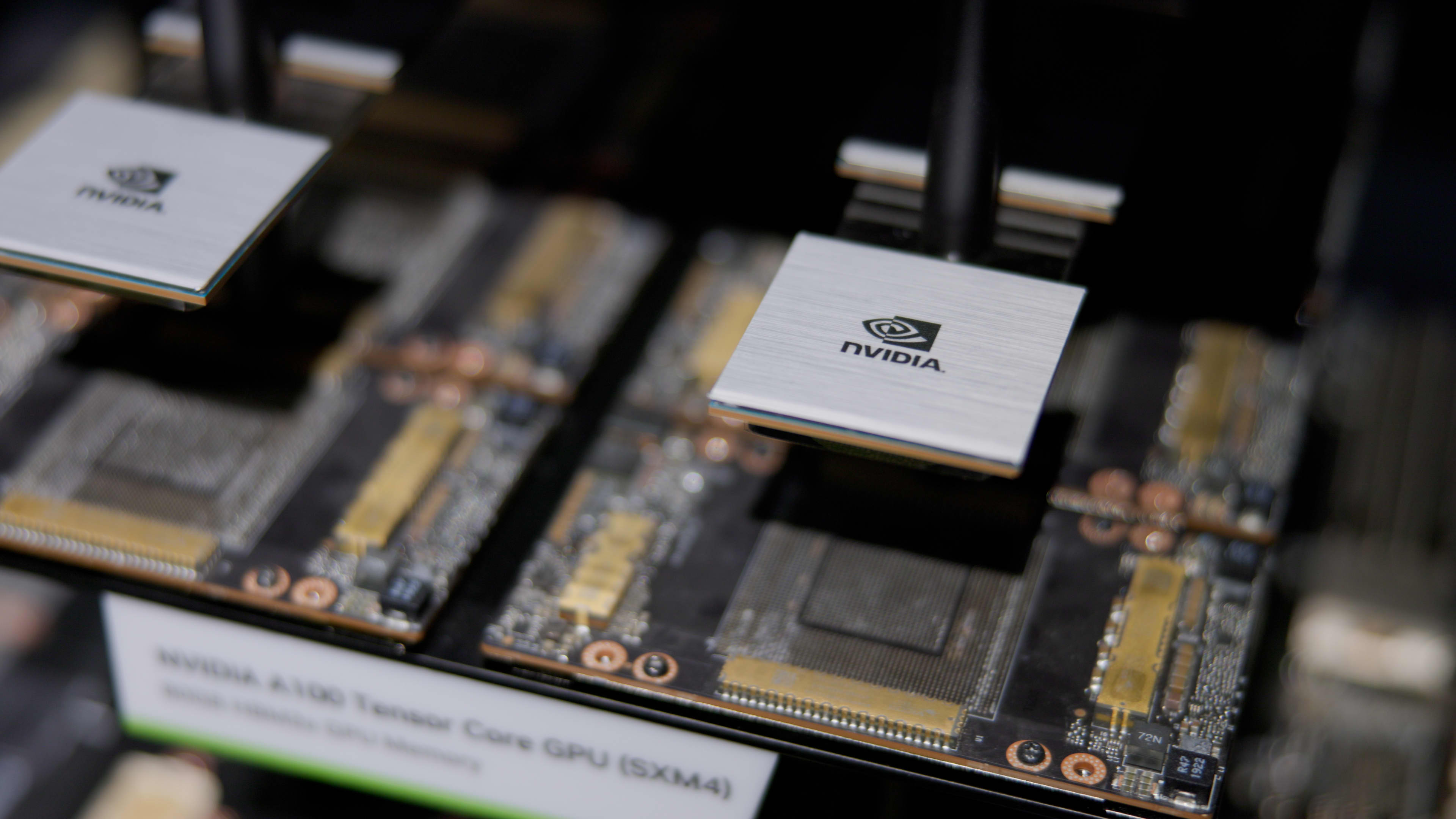

Synthesia, a digital media platform that lets users create artificial intelligence-generated videos, has raked in $90 million from investors — including U.S. chip giant Nvidia, the company told CNBC exclusively.

The London-based company raised the cash in a funding round led by Accel, an early investor in Facebook, Slack and Spotify. Nvidia came in as a strategic investor, putting in an undisclosed amount of money. Other investors include Kleiner Perkins, GV, FirstMark Capital and MMC.

Founded in 2017 by researchers and entrepreneurs Victor Riparbelli, Matthias Niessner, Steffen Tjerrild and Lourdes Agapito, Synthesia develops software that allows people to make their own digital avatars to deliver corporate presentations, training videos — or even compliments to colleagues in more than 120 different languages.

Its ultimate aim is to eliminate cameras, microphones, actors, lengthy edits and other costs from the professional video production process. To do that, Synthesia has created animated avatars which look and sound like humans, but are generated by AI. The avatars are based on real-life actors who speak in front of a green screen.

“Productivity can be improved because you are reducing the cost of producing the video to that of making a PowerPoint,” Philippe Botteri, at Accel, the lead investor in Synthesia’s Series C, told CNBC, adding that adoption of video has been proliferated by consumer platforms such as YouTube, Netflix and TikTok.

“Video is a much better way to communicate knowledge. When we think about the potential of the company and the valuation, we think about what it can return, [and] in the case of Synthesia, we’re just scratching the surface.”

Synthesia is a form of generative AI, similar to OpenAI’s ChatGPT. But the company says it has been working on its own proprietary generative AI for years, and that although ChatGPT may have only recently emerged into public consciousness, generative AI itself isn’t a new technology.

Synthesia sells to enterprise clients, including Tiffany’s, IHG and Moody’s Analytics. The company doesn’t disclose its sales or revenue metrics, though it says it has “consistently driven triple digit growth,” with over 12 million videos produced on the platform to date. The number of users on Synthesia spiked 456% year over year, the company said.

Synthesia plans to ramp up investment into its technology, with a particular focus on advancing its AI research and making Synthesia avatars capable of performing more tasks.

“We work with 35% of the Fortune 100 [with a focus on] product marketing, customer support, customer success — areas of the company you have a lot of text that you want to turn into video,” Riparbelli told CNBC.

“As we’re progressing to the next phase of the next generation of Synthesia technology, it’s all about making the avatars more expressive, be able to do more things, walk around in a room, have conversations,” he added.

Riparbelli explained Nvidia isn’t just a semiconductor manufacturer — it’s also a powerhouse of research and development talent with an army of engineers, academics and researchers who produce papers on the subject.

“They’re not just a chip producer,” he said. “They have amazing research teams that are very much leading in terms of, how do you actually train these large models? What works, what doesn’t work?”

Investor interest in A.I.

Business Insider previously reported that Synthesia was in talks with investors to raise between $50 million and $75 million in new funds at a valuation of around $1 billion.

The report didn’t include detail about Nvidia’s involvement, nor mention the total $90 million sum raised.

Synthesia is one of many firms attracting interest from investors with AI and enterprise software that can reduce costs involved in certain business processes. Companies are looking to lower expenses everywhere they can to combat climbing inflation and prepare for a possible recession.

Last week, French business planning software company Pigment raised $88 million from investors including Iconiq Growth, Felix Capital, Meritech IVP and FirstMark, in part to ramp up its investment in AI.

Generative AI has been a rare bright spot in a European tech market reeling from declining funding and a pullback in valuations. Investors have rotated out of high-growth tech firms into value sectors with more resilient income generation, such as financials, industrials, energy and consumer staples.

Recently, a report from venture capital firm Atomico showed funding for Europe’s technology startups was on track to fall a further 39% in 2023 to $51 billion from $83 billion in 2022.

However, AI was one area that drew more investments, Atomico said, with generative AI accounting for 35% of total investment into AI and machine learning firms last year — the highest share ever and a big jump from 5% in 2022.

Ethical concerns about deepfakes

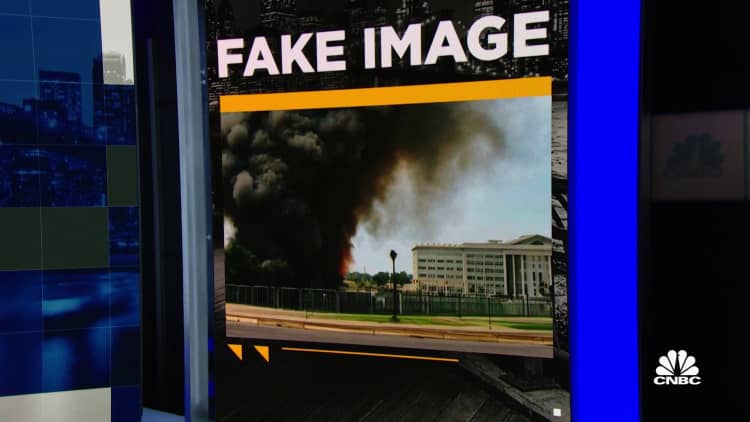

There are concerns that the use of video AI tools as advanced as Synthesia could lead to deepfakes, videos which take a user’s likeness and manipulate it to make it appear as though they are saying or doing something they’re not.

There has also been an increasing number of calls from tech leaders and academics for a global pause on AI development beyond systems like OpenAI’s GPT-4, because of fears that the technology is becoming so advanced it may pose an existential risk to humanity.

Synthesia first attracted mainstream attention in 2019 for a deepfake video that featured a digitally animated version of celebrity soccer player David Beckham speaking about a campaign to end malaria in nine languages.

While that was done with the consent of Beckham and for a good cause, more widespread use of deepfake technology has led to worries about the potential for misinformation.

To address that, Synthesia says it has kept ethics in mind while developing its software. The company requires consent from the people who feature as avatars in its software, and uses a mix of humans and machine learning to target material such as profanity and hate speech.

It is also signed up to Responsible Practices for Synthetic Media, a voluntary industrywide framework for the ethical and responsible development, creation and sharing of synthetic media.

“There are many different discourses going on right now. There’s one about the very long-term existential sort of risk scenarios. I think they’re important to talk about as well. But I’d love to see more focus on where are we today?” Riparbelli told CNBC in an interview.

“These technologies are already powerful. How do we deal with hallucinations? How do we deal with all of the problems that arise?” he added. “There’s definitely pitfalls. But there’s also just so much opportunity in it, I think, leveling the playing field and enabling people to do much more with less.”