Finance & Banking

,

Fraud Management & Cybercrime

,

Government

Bank Execs at Senate Hearing Defend Zelle Reimbursements, Payment Fraud Programs

U.S. Sen. Richard Blumenthal, D-Conn., revealed that Bank of America, JPMorgan Chase and Wells Fargo only reimbursed 38% of customers for unauthorized payments – leaving them on the hook for $100 million in fraud losses. The banks disputed the committee’s findings during a hearing Tuesday.

See Also: Webinar | Everything You Can Do to Fight Social Engineering and Phishing

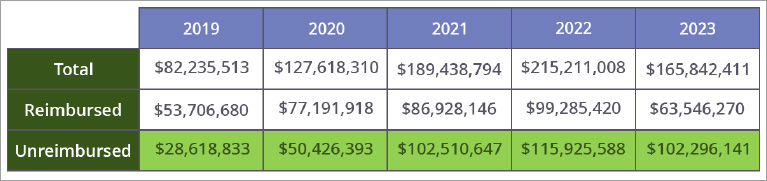

The Senate Homeland Security and Governmental Affairs Committee asked the bank executives present about their Zelle reimbursement program, citing a Permanent Subcommittee on Investigations inquiry that found the three banks reimbursed customers for about 38% of the $166 million in unauthorized fraud disputes.

Blumenthal pointed out that banks are required by the Electronic Fund Transfer Act to reimburse consumers for unauthorized fraud. In total, these banks rejected scam disputes worth a combined total of approximately $560 million from 2021 through 2023.

The Permanent Subcommittee on Investigations launched an inquiry into Early Warning Services, which operates the Zelle Network, and the three largest banks that offer Zelle and co-own EWS. Collectively, these banks facilitated 73% of all Zelle payments in 2023.

Representatives of the banks and Cameron Fowler, the CEO of Early Warning Services, disputed the allegations, saying that they have reimbursed 100% of unauthorized fraud. They said some consumers claim unauthorized fraud, but the investigation shows no evidence of fraud.

Since its creation in 2017 by America’s largest banks to enable instant digital money transfers, Zelle has become the country’s most widely used money transfer service. With 2,100 banks and credit unions in the Zelle Network, 80% of U.S. deposit accounts can use Zelle. The total number of transactions on Zelle increased more than 10 times in the five years between 2018 and 2023 – from $75 billion to $806 billion.

Banks Pledge to Combat Fraud

JPMorgan Chase, Bank of America and Wells Fargo representatives told the subcommittee they have addressed scams through technology-based prevention methods, such as data analytics, warning messages about potentially suspicious transactions, and consumer education campaigns. They said that 60% of scams on Zelle originate on social media.

Fowler said, “Industries must work together to stop fraud and scams from where they originate. Government also plays a role by enabling policy solutions and providing the resources needed to root out the causes of fraud.”

He added that 99.9% of Zelle transactions are completed without any report of fraud or scam. “Financial institutions in Zelle network are required to reimburse customers who have faced unauthorized fraud. We require banks to reimburse victims of impostor scams – where the consumer is duped into sending money to criminals, posing as government agents, financial institutions or service providers.”

Melissa Feldsher, head of payments, lending innovation and loyalty at JPMorgan Chase, said the fraud rate on the Chase-Zelle network was lowest in 2023 and further decreased in the first half of 2024.

Non-Zelle Scams

While the focus has been on Zelle, fraud experts point out that 95% of scams do not occur on Zelle. “The government must implement comprehensive policies addressing all kinds of scams, not just those involving unauthorized payments. This should include stringent controls and penalties, similar to models used in other countries like Australia,” said Ken Palla, retired director of MUFG Bank.

“By broadening the scope of regulatory oversight and ensuring robust fraud prevention measures across all payment platforms, we can better protect consumers and enhance the integrity of our financial systems.”